who pays sales tax when selling a car privately in ny

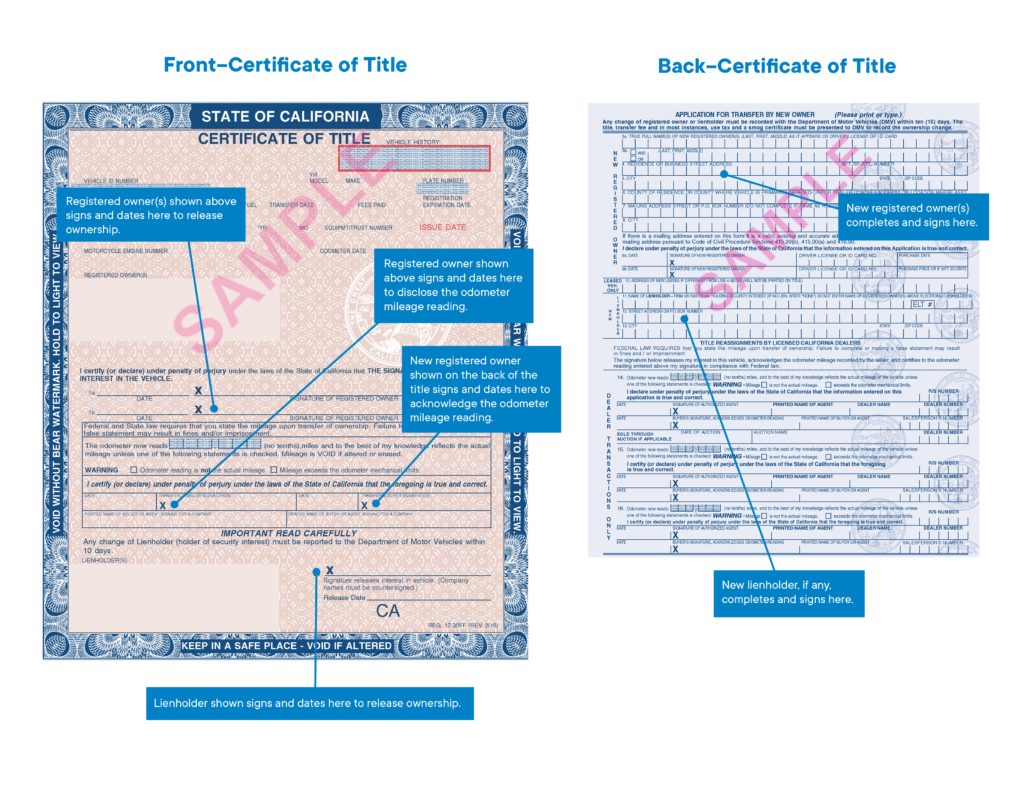

In New York even if the vehicle is owned by two owners only one of the owners is required to sign the title in order to transfer ownership. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

How To Sell A Car In New York Title Transfer And Seller Duties

Download Your Selling Your Car Privately Now.

. To apply see Tax Bulletin How to Register for New York State Sales Tax TB-ST-360. Once the buyer has the vehicle registered under his name he must pay to sell Texas. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

That single missing digit voided the title. Make sure the vehicle identification number VIN on the title matches the VIN on the car. This tax only applies to New York City and a few other counties scattered across the state.

New York City charges 30 the highest rate in the state. Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption. 592172 It is not that hard to get unlimited free.

Customize for Immediate Use. Ad Free Fill-in Legal Documents. You do not need to pay sales tax when you are selling the vehicle.

You can refer to the list of counties that impose this tax during car registration. The DMV office collects the sales tax from the new owner if the new owner is required to pay any sales tax. Proof of Ownership Buyers should ask to see the title to verify VIN and ownership.

The dealer must reveal on the sales contract when a passenger car had been used primarily as a fleet car. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US.

Provide other acceptable proofs of ownership and transfer of ownership. Make that amount payable to Commissioner of Motor Vehicles. Register and title the vehicle or trailer.

Otherwise all other counties either charge 10 or 20 depending on your vehicles weight. After the title is transferred the seller must remove the license plate from the vehicle. When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is exempt.

Box 68597 Harrisburg PA 17106-8597. Yes you must pay vehicle. All you need to know to sell or gift a car in NY.

Make a copy of the NYS lien release form or letter from the lienholder for your records but send the original to the DMV as only that is acceptable for these purposes. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher. The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO.

Check out the facts with IMPROV. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Supplemental MCTD is 50.

Complete and sign the transfer ownership section of the title certificate and. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. 247 Support 800 660-8908.

The buyer will have to pay the sales tax when they get the car registered under their name. The dealer must provide the buyer with odometer and salvage disclosure statements. Thankfully the solution to this dilemma is pretty simple.

Instead the buyer is responsible for paying any sale taxes. Personalize Print Instantly. Sign a bill of sale even if it is a gift or.

Also include your current title certificate and a check or money order for 20. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. This important information is crucial when youre selling.

It might sound obvious but a lot of people forget to check. Publication 838 1212 Penalties for operating without a valid Certificate of. If the VIN doesnt match have the seller correct it before you buy the car.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Gift or selling a car in New York is broken down in this article. To transfer ownership of an original New York State Certificate of Title the buyer must fill out the and sign the transfer section of the proof of ownership.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Getting Documents to the DMV.

How To Write A Bill Of Sale Howstuffworks

Ohio Sales Tax Guide For Businesses

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

Is There A Sales Tax When You Sell A Car In A Private Transaction Quora

Can My Friend Sell Me A Car For 1 Quora

Can I Personally Sell My Car To My Corporation If I Am The President And Also Can I Claim That As A Business Expense Along With The Cost For Repairs Quora

Can I Sell An Unregistered Car In California Because I Do Not Want To Pay The Registration Fee I M Selling My Car But The Registration Expires Soon And The Private Buyer Needs

How To Sell A Car In New York Title Transfer And Seller Duties

Rent Your Car Out To Someone For An Extra 9 000 Year

How To Sell A Car With A Lien Credit Karma

How To Sell A Car In New York Title Transfer And Seller Duties

What Is Capital Gains Tax And When Are You Exempt Thestreet

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

How To Sell A Car In New York Title Transfer And Seller Duties